The power of early financial literacy

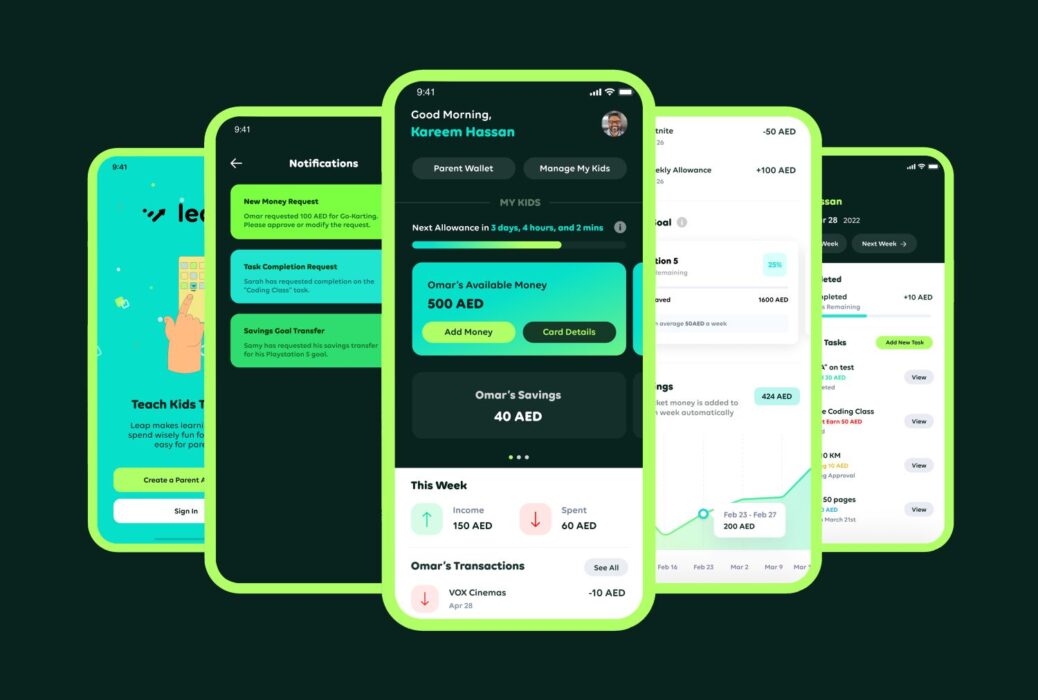

Ziad Toqan, Co-Founder of Leap, explains how the innovative app and prepaid Leap are reshaping financial education, offering practical experience and empowering young minds with skills to navigate the digital age.

In an era of constant change and evolving challenges, it’s our duty to prepare the next generation for the road ahead. As a new academic year approaches, the spotlight turns to a skill that often gets overlooked in traditional education: financial literacy. In this digital age, where financial decisions are increasingly complex, nurturing sound money habits from an early age is no longer a luxury—it’s a necessity. This is where the innovative app and prepaid Leap steps in, reshaping how we teach our youth about money.

Learning by Doing: Leap’s Practical Approach

The traditional approach to financial literacy often leaves young minds grappling with abstract concepts and terms. Leap shifts the paradigm by offering practical experience. Its interactive simulations provide a controlled environment for teenagers to grasp real-world financial situations. Imagine this: budgeting for everyday expenses like going out with friends, saving up for a coveted pair of shoes, or setting aside money for that video game they’ve been eyeing. These real-world scenarios serve as training wheels for responsible decision-making, enabling them to see first-hand the results of their choices.

Building a Foundation for Life

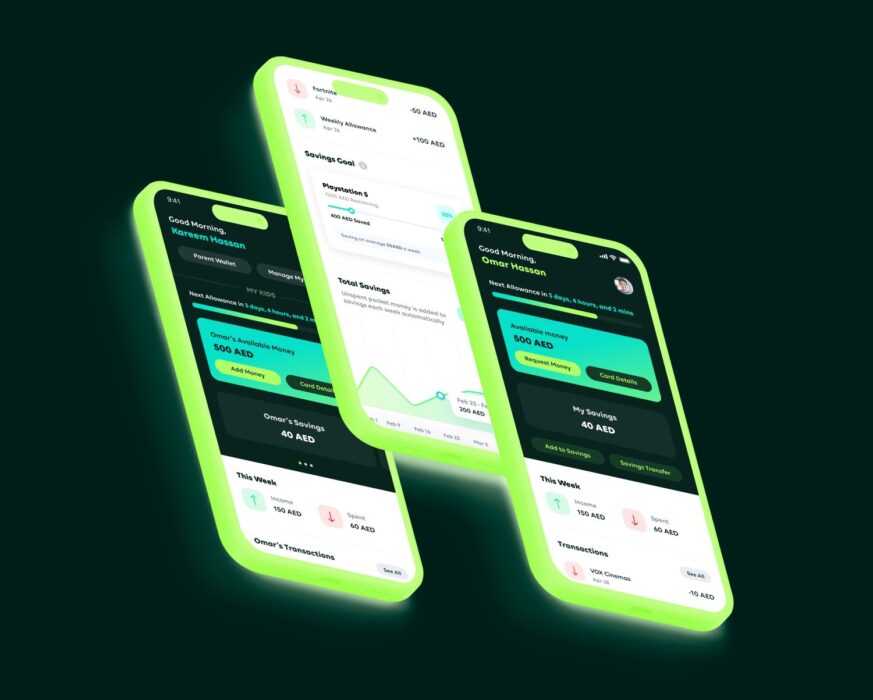

The argument for starting financial education early is compelling. Imagine a world where every young adult enters the financial arena with confidence, armed with practical skills to navigate the complex terrain. Leap doesn’t just teach teenagers how to manage money; it nurtures a mindset that lasts a lifetime. By encouraging goal setting, Leap creates a sense of purpose in financial decisions. As they hit targets like saving up for that bag, pair of shoes, or video game, tangible rewards underscore the importance of smart money management, fostering a positive relationship with financial responsibility.

Empowering Financial Independence

Leap’s philosophy centres on empowering teenagers with financial independence. This isn’t about letting them swim in the deep end unaided; it’s about giving them the tools to paddle confidently. Through trial and error, they learn valuable lessons, developing resilience that’s crucial for adulthood. Leap recognizes that parents are key partners in this journey. The app’s interface allows parents to monitor their teenager’s financial progress, transforming conversations from lectures into collaborative discussions on how to achieve those financial goals.

Adapting to the Digital Age

Adapting to the digital age in a world where cash is becoming obsolete, and transactions are digital, traditional piggy banks don’t cut it. Today’s youth need more than theoretical knowledge; they require practical digital skills. Leap bridges this gap, guiding them through the complexities of online transactions and digital budgeting tools. By doing so, it prepares them for a future where understanding online security, digital payments, and investments are essential life skills. For instance, they learn how to navigate digital payment apps and make secure online purchases.

The Road to Financial Well-being

Financial literacy isn’t just about managing money; it’s about making informed choices that set the stage for financial well-being. It’s about deciphering jargon, understanding credit scores, and navigating student loans. By equipping young minds with these skills, we empower them to break free from financial insecurity cycles. For example, they’ll be able to compare credit card offers intelligently and understand how loans and interest work.

Leap into a Brighter Future

The journey toward financial literacy begins with a single step—one that leads to a brighter future for us all. As the new academic year dawns, let’s recognize the significance of early financial education. Initiatives like Leap, which bridge classroom lessons with real-world practicality, are essential. By investing in financial education, we invest in a future where today’s youth have the confidence and competence to secure their own financial destinies.

In the face of ever-evolving financial landscapes, financial literacy isn’t just a soft skill—it’s a survival skill. It’s the tool that empowers the next generation to make informed choices, break free from the cycle of uncertainty, and shape responsible and secure futures. So, let’s embrace the power of early financial literacy and work together to ensure that our youth have the tools they need to thrive in an increasingly intricate financial world.

Comments