Teaching teens financial literacy with Leap

We look at a new app that can help you empower your child or teen to learn good financial skills in an engaging and accessible way!

As the new academic year approaches, parents everywhere are gearing up to equip their teens with essential skills for a successful future. One crucial aspect that often goes overlooked is financial literacy, which forms the foundation of responsible money management. It can be a tricky topic and sometimes parents could do with a little help. Let’s take a look at a new app that can be used as a tool to teach kids and teens good money habits.

What is Leap?

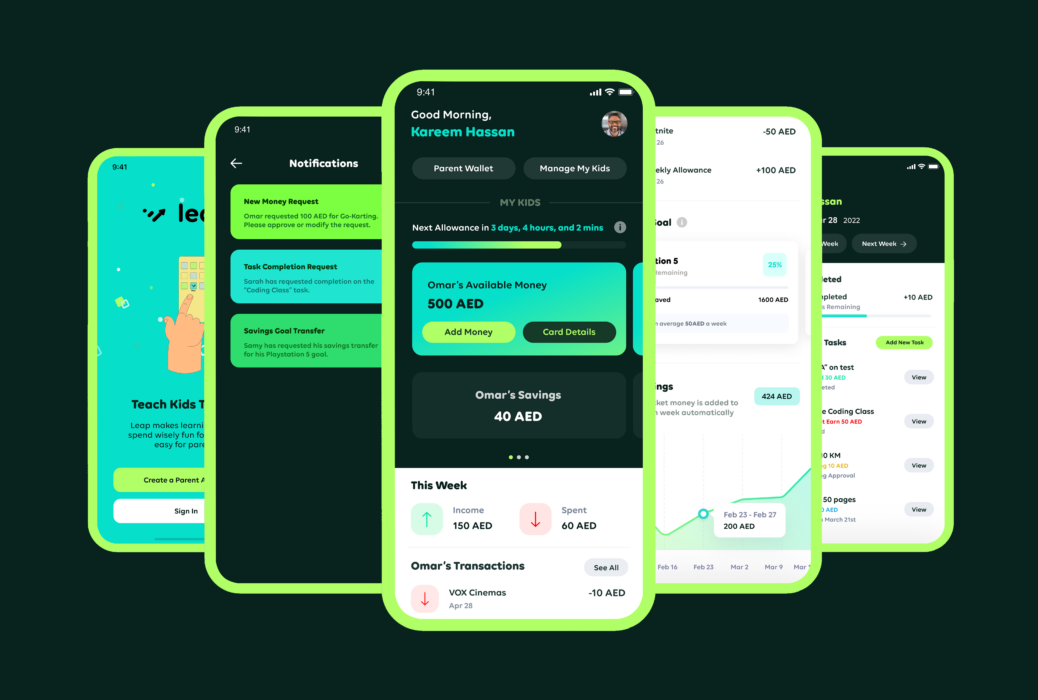

Leap is a new mobile app and prepaid Visa card designed to empower children and teenagers aged 6-18 years old with financial knowledge and healthy money habits. Leap is more than just an app; it’s an educational tool that transforms the way parents teach their children about money and financial responsibility. Developed with a clear focus on empowering kids and teens to make informed financial decisions, Leap offers an engaging platform for learning the building blocks of earning, saving and spending money wisely.

Empowering financial independence

With Leap, teenagers gain practical experience in managing money independently. From setting savings goals to making responsible spending decisions, teens are equipped with the confidence and skills to navigate the financial challenges of adulthood.

Real-life simulations

Leap incorporates interactive real-life simulations, allowing children and teenagers to apply financial concepts in practical scenarios. Whether it’s budgeting for school supplies or planning for extracurricular activities, these simulations prepare teens to face real-world financial challenges head-on.

Progress tracking and support

For parents, Leap offers a user-friendly interface that allows effortless tracking of their teen’s financial progress. Parents can gain valuable insights, identify areas where a child needs additional support and celebrate their teen’s achievements, fostering a positive and rewarding learning experience.

Financial goal setting and rewards

By encouraging teens to set financial goals, Leap instils a sense of purpose and motivation in their financial journey. As they achieve these milestones, real-life incentives and rewards help reinforce the value of saving and responsible spending.

“We believe that the new academic year presents a perfect opportunity to equip our teenagers with essential life skills – and financial literacy is a vital aspect of their development,” says Ziad Toqan, Co-founder and CEO of Leap. “With Leap, parents can rest assured that their teens are well-prepared to handle financial challenges and make educated choices throughout their lives.”

Bridging the gap

As technology continues to shape the world, the importance of financial literacy for teenagers cannot be overstated. Leap bridges the gap between traditional education and real-world practicality, ensuring that the next generation is ready to face financial challenges with confidence and competence.

To get started or learn more, visit www.savewithleap.com and sign up for a free account. Leap is availablefor download via the App Store and Google Play, with a one month complimentary subscription upon downloading.

Comments